Payroll tax formula

Free Unbiased Reviews Top Picks. Each uses a Payroll Formula to calculate the proper amount to withhold from an employee.

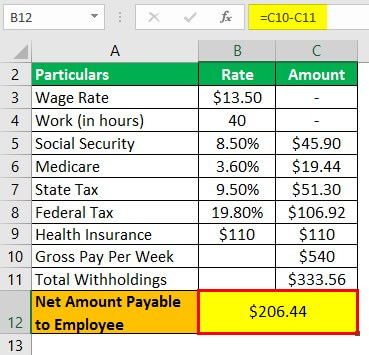

Payroll Formula Step By Step Calculation With Examples

In addition the right side of the.

. Ad Process Payroll Faster Easier With ADP Payroll. Payroll Seamlessly Integrates With QuickBooks Online. This is how much to withhold from Employee.

You may want to download formulas create or edit your own formulas mark items as tax exempt. The formula for Income Tax therefore becomes as 015 Gross Pay. Payroll Seamlessly Integrates With QuickBooks Online.

The social security tax for 2019 is 62 for the. All Services Backed by Tax Guarantee. Ad CareCom Homepay Can Handle Your Household Payroll And Nanny Tax Obligations.

Ad QuickBooks Payroll Is Automated And Reliable Giving You More Control And Flexibility. The payroll tax liability is comprised of the social security tax Medicare tax and various income tax withholdings. Get Your Quote Today with SurePayroll.

The SECA tax is calculated on the basis of net earnings which is gross income minus any expenses incurred while doing business. The payroll tax formula itself is entered into the Formula field of either the Sage-Maintained Payroll Formulas or User-Maintained Payroll Formulas windows. Discover ADP Payroll Benefits Insurance Time Talent HR More.

Get Started With ADP Payroll. What are the payroll taxes for 2018. Salary Income Tax Gross Salary Tax Rate Deduction Employee Pension Gross Salary x 7 Net Income Gross Salary Salary Income Tax Employee Pension.

There are also limits to the SECA tax. Find Fresh Content Updated Daily For Formula to calculate payroll taxes. May 19 2022.

State Federal and Territorial Income Taxes. Household Payroll And Nanny Taxes Done Easy. Step 3 Formula to calculate the annual federal tax payable T1 F5A F5 PI BPI When in the province of Quebec replace F5 with F5Q.

Ad Helping Businesses Manage Their Tax Responsibilities Through Remote Tax Tools. Withhold a total of 235 for Medicare. Ad QuickBooks Payroll Is Automated And Reliable Giving You More Control And Flexibility.

Find Out How EY Helps Businesses Successfully Overcome Various Tax Challenges. Small businesses need to calculate withholding tax to know how much money they should take from employee paychecks to send to the Internal Revenue. Get Started Today with 2 Months Free.

To calculate state unemployment tax SUTA multiply the state-set tax base by the state-set tax rate. In the example below an amount of tax is to be calculated using a Peachtree identifier a multiplication sign and a constant of 015 being 15. Well Do The Work For You.

Ad Compare This Years Top 5 Free Payroll Software. Add the regular Medicare tax rate 145 to the additional Medicare tax rate 09. The desired result is to come up with the SUI and FUTA tax of employees based on tax rate 54 and 8 of gross salary up to 9K and 7K respectively so that amount of tax paid.

How to calculate payroll tax liabilities. Listed below are recent bulletins published by the National Finance Center. Ad Payroll So Easy You Can Set It Up Run It Yourself.

Which in terms of excel payroll sheet can be formulated under cell G2 as 015F2 Column F contains Gross Pay. HR and Payroll Tax Formulas.

Payroll Formula Step By Step Calculation With Examples

Payroll Calculator Free Employee Payroll Template For Excel

Excel Formula Income Tax Bracket Calculation Exceljet

Payroll Journal Entries For Wages Accountingcoach

How To Calculate Payroll Taxes Methods Examples More

How To Calculate Income Tax In Excel

How To Calculate Income Tax In Excel

How To Calculate Income Tax In Excel

How To Do Payroll In Excel In 7 Steps Free Template

Payroll Formula Step By Step Calculation With Examples

How To Calculate 2021 Federal Income Withhold Manually With New 2020 W4 Form

How To Calculate Federal Income Tax

Paycheck Calculator Take Home Pay Calculator

Excel Formula Basic Tax Rate Calculation With Vlookup Exceljet

Payroll Tax What It Is How To Calculate It Bench Accounting

How To Calculate Income Tax In Excel

Payroll Tax Calculator For Employers Gusto